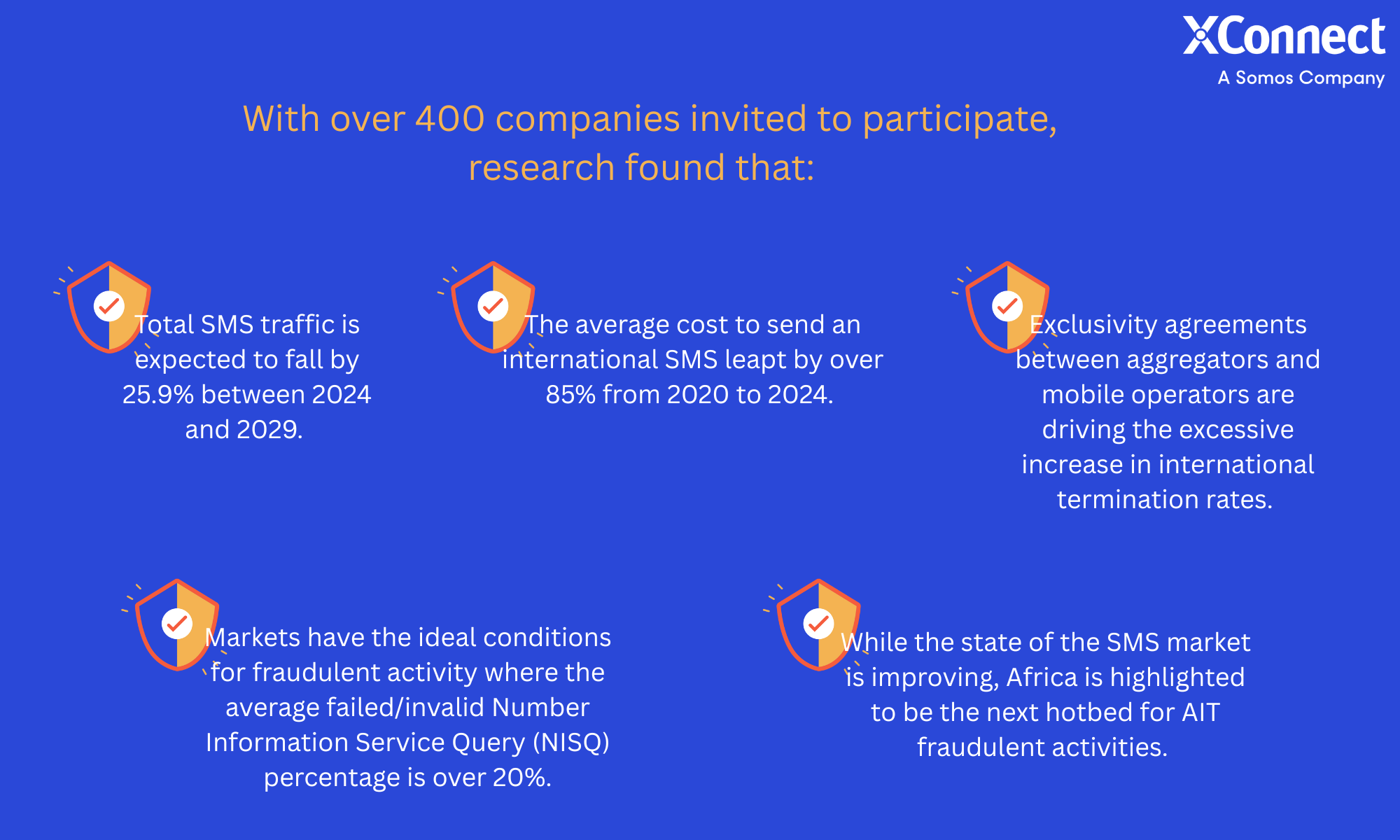

The A2P SMS industry is now entering a period of decline, as the slowdown in domestic traffic growth means it’s no longer offsetting the drop in international traffic. As fraud risks grow and international termination rates (ITR) increase, the telecoms industry must prioritise restoring trust in A2P SMS as a communications channel. Our latest report with Mobilesquared, ‘How Do We Create a Sustainable Future for A2P SMS?, revealed that over 50% of service providers expect SMS to experience an increase in fraud in 2025. With this, less than a third are expecting SMS to become a cleaner channel within the same period.

Slowing Fraud, Increasing Growth: How Do We Create a Sustainable Future for A2P SMS?

Harmful traffic and associated activities have blighted the SMS landscape since 2021, creating lasting damage. This is due to several factors, from the rise of Artificially Inflated Traffic (AIT) to over-monetisation, price increases and interconnect fraud.

The growing complexity of the A2P SMS market is a situation that must be addressed to limit its decline in coming years. This will be vital to ensuring a more measured and stable environment for the entire value chain.

A2P SMS and the Rising Industry Risks

A2P SMS and the Rising Industry Risks

After the growth and adoption of SMS over the last decade, the A2P SMS channel has been exposed to new challenges.

One prominent type of fraud affecting the industry is AIT fraud. This occurs when threat actors request a one-time password or two factor authentication to a premium number, incurring costs for organisations who originate the message. At the same time, the industry is also battling with price increases, leading to organisations exploring more cost-efficient alternatives. Our research with Mobilesquared provides insight into the ways the A2P SMS industry can protect revenue, brand reputation, and overall trust in the telecoms industry.

The ‘good’ markets (NISQ growth below 500% and an international termination rate below $0.10) account for 84.2% of total A2P SMS traffic in 2024. By region, 67% of North America and 60% of West Europe are good markets.

The ‘bad’ markets (NISQ growth in excess of 500% and an ITR over $0.10) accounted for 3.58% of total traffic. Almost 80% of total NISQs in 2024 occurred in good markets, 13.5% in bad markets, and 6.94% in indifferent markets. This confirms the research data from XConnect customers that they are using NISQ to ensure the safe passage of their SMS traffic.

Reducing Fraud, Protecting Customers

Reducing Fraud, Protecting Customers

Despite the challenges currently facing A2P SMS, it remains the business messaging channel of choice and continues to be the platform that brands use as the foundation of their rich messaging offering.

In line with this, the majority of XConnect NISQ customers are looking to increase their protection against fraud, while maximising SMS revenues and margins via efficient and accurate routing of traffic.

With XConnect solutions such as IRSFCheck™ and AITCheck™, provided through the RiskALERT™ portfolio suite, mobile network operators, CPaaS providers and enterprises can protect their traffic from high-risk fraud destinations. As the SMS industry ramps up its efforts to reduce fraud, AITCheck directly addresses AIT instances in real time. Our solution provides insight into whether the number is valid, ported and allocated to protect revenues against bot attacks on A2P services.<